Will the 2025 Trade War Skyrocket Your Digital Signage Costs? (Spoiler: Here’s How to Win)

The 2025 Trade War & Digital Signage: What Buyers Need to Know

As U.S.-China trade tensions escalate in 2025, global procurement teams face a pressing question: Will tariffs send digital signage costs soaring? The answer isn’t black and white—but with smart planning, you can dodge price hikes while securing cutting-edge displays for hospitals, retail hubs, or transit systems. Let’s unpack how trade policies will reshape pricing and what you can do about it.

1. How Tariffs Could Reshape Digital Signage Pricing

The U.S. has proposed a 35–50% tariff hike on Chinese electronics, targeting components like LED panels, touchscreens, and IoT modules—the backbone of modern digital signage. Meanwhile, China’s retaliatory measures aim to boost domestic tech innovation, offering tax breaks for AI-integrated displays and green energy solutions.Key Impacts for Buyers:

- Higher Costs for U.S.-Bound Shipments: Displays using Chinese-made parts (even if assembled elsewhere) could see price jumps of 20–30%.- Opportunities in Tax-Exempt Tech: Suppliers leveraging China’s reduced tariffs on AI-driven signage (e.g., facial recognition ads) may offset costs.

- Regional Manufacturing Shifts: Vendors like Shenzhen ViewSonic now blend Chinese R&D with assembly in Vietnam or Mexico to bypass tariffs.

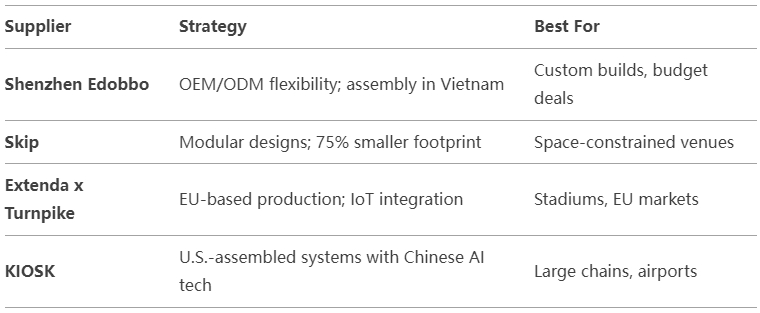

2. Top Tariff-Resilient Digital Signage Suppliers

Here’s a snapshot of vendors adapting to trade turbulence:

Pro Tip: Avoid suppliers reliant on cross-border part shipments. Prioritize vendors with ASEAN or North American factories.

3. 5 Cost-Saving Strategies for 2025 Procurement

A. Target Tax-Exempt ComponentsChina’s 2025 tariff plan slashes rates for energy-efficient LED panels and AI-driven software. Partner with suppliers like Nanjing SignTech that prioritize these parts.

B. Embrace Modular Designs

Samsung’s VXT series lets you swap out tariff-hit components (e.g., touchscreens) without replacing entire units—a lifesaver if tariffs spike mid-project.

C. Leverage Free Trade Zones

Shipments routed through China’s 34 duty-free partners (e.g., Maldives, Cambodia) can cut costs by 15–20%.

D. Negotiate Bulk Contracts

Suppliers like LG offer 10–12% discounts for orders exceeding 500 units, locking in pre-tariff rates for 2–3 years.

E. Explore Refurbished Displays

Post-trade war, secondary markets for lightly used signage (e.g., trade show displays) are booming. Platforms like SignageSwap offer certified models at 40% off retail.

4. Real-World Wins: Beating Tariff Hikes

- Hospital Procurement: A Texas hospital network saved $1.2M by sourcing AI triage displays from ViewSonic’s Mexico line, avoiding U.S. tariffs on Chinese-assembled units.- Retail Resilience: Dubai Mall uses Samsung VXT modular screens with EU-made panels, sidestepping China-U.S. friction while cutting energy costs by 25%.

- Airport Innovation: Singapore Changi Airport deployed Nanjing SignTech’s tax-exempt AI wayfinding screens, reducing import costs by 18%.

5. Future-Proofing Your Digital Signage Strategy

Tech Trends to Watch:- 3D-Printed Components: Suppliers like SignTech now 3D-print non-critical parts locally to reduce import dependencies.

- Blockchain Supply Chains: Tools like IBM’s TradeLens track component origins in real time, ensuring compliance and minimizing tariff risks.

- AI-Driven Tariff Analytics: Platforms like TariffGuard auto-classify shipments for optimal duty rates, saving buyers 10–15 hours/month.

Long-Term Checklist:

✅ Partner with suppliers using ASEAN/Mexico factories

✅ Demand transparency on component origins (e.g., “Made in Vietnam” vs. “Assembled in Vietnam”)

✅ Invest in software-upgradable hardware to avoid tariff-prone hardware refreshes

The Bottom Line

The 2025 trade war will disrupt digital signage pricing—but agile buyers can turn chaos into opportunity. By aligning with adaptable suppliers, leveraging tax breaks, and embracing modular tech, you’ll keep projects on budget without sacrificing innovation.Current page link:https://www.touchkiosk.com/news/397.html

Tags:

digital signage,2025 tariffs,tariff-resilient suppliers